malaysian taxation question and answer

To practice TX MYS exams in the CBE environment you can. Rates of tax and tables are printed on pages 24.

Company Super Form Malaysia Malaysia Company Make Business

This question paper is divided into two sections.

. In Malaysia each source of income is distinguished for the purpose of determining the statutory income from that source. This paper consists of FIVEquestions. Malaysian Institute of Accountants Established under the Accountants Act 1967 Institut.

Income Tax Questions And Answers Q11Which income is considered as accrued income. During reading and planning time only the question paper may be. In other words expenses incurred in earning the gross.

TAX RATES AND ALLOWANCES The following tax rates allowances and values are to be used in answering the questions. Do NOT open this question paper until instructed by the supervisor. Seribayu Enterprise is a partnership business owned by Seri and Bayu engaged in supplying fresh flowers to customers.

Taxation Exam Malaysia answer and question with summaries. Partnership Malaysian Taxation Question and Answer 18 Jan 2021. 30 MINUTES Mr Lee is a Malaysian citizen and he got married to his wife an Australian.

There are only two history of Malaysia Taxation are Income Tax Ordinance 1947 and Sarawak Inland Revenue Ordinance 1960. 15 Questions Show answers Question 1 30 seconds Q. Malaysian Taxation Question 1 A.

15 Questions Show answers Question 1 30 seconds Q. Taxation TX Past exam library Malaysia MYS To view PDFs of past exam papers for Malaysia please select from the list below. Income tax is collected on all types of income except.

We were ok with that. Hours 15 minutes this question paper is divided into two sections. A tax that takes a larger percentage from high-income earners than it does from low-income earners is called A proportional tax B progressive tax C regressive tax.

Nevertheless before the creditor files a bankruptcy notice in court. Malaysian taxation question and answer nov 2019 question and answer part 1. THE MALAYSIAN ADMINISTRATIVE MODERNISATION AND MANAGEMENT.

Ans- Income which has been earned but not yet received is known as accrued income. Taxation malaysia 2018 sample questions f6 mys acca time allowed. Section ll 15 questions.

Sorry this Digital Service is available to authorized users only Close. Past Year Question - MIA Qualifying Examination - September 2019. They stay together in Malaysia as Mr Lee.

Accounting questions and answers QUESTION 2 10 MARKS. Finance questions and answers. TAXATION IN MALAYSIA 2020 ANSWER ALL QUESTIONS Explain the theory of Double dividend of taxation.

The Malaysian Insolvency Department has no jurisdiction over this matter. You may answer this paper EITHERin EnglishORin Bahasa Malaysia. Business Taxation Multiple Choice Questions INCOME TAX ACT 1961 1.

It depends on the creditors. The amount equivalent to monthly tax deductions in Malaysia. Frequently Asked Questions for Malaysian Personal Income Tax.

Only ONE language is to be used. Txmys 2018 sep and dec. 8 marks Provide the exception to the rules of determining the scope of the.

The tax equalization were imposed only on salary only and never on overseas allowance. Read on as we reveal the answers to the frequently asked questions for Malaysian income tax. View Taxation_Question_2020_Marchpdf from ART 3240 at University Malaysia Sarawak.

SeptemberDecember 2018 Sample Answers Taxation Malaysia TX. Income tax rates Resident individuals Chargeable income Rate. View Answer In a major recession year a corporation has a taxable income of 200000 a tax-exempt interest of 260000 and a federal income tax refund of 80000 from overpayment of.

Tutorial 1 Btw 3153 Tutorial 1 Question 1 I What Are The Important Characteristics Of An Studocu

Cukai Pendapatan How To File Income Tax In Malaysia

Company Super Form Malaysia Malaysia Company Make Business

Tetiana Polonska International Tax And Transfer Pricing Manager Ey Linkedin

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

Taxation Assignment Help Assignment Help Australia Uk Usa Malaysia 9 5 Page On All Writing Assignments Helpful Writing

Mygov Managing Finance And Taxation

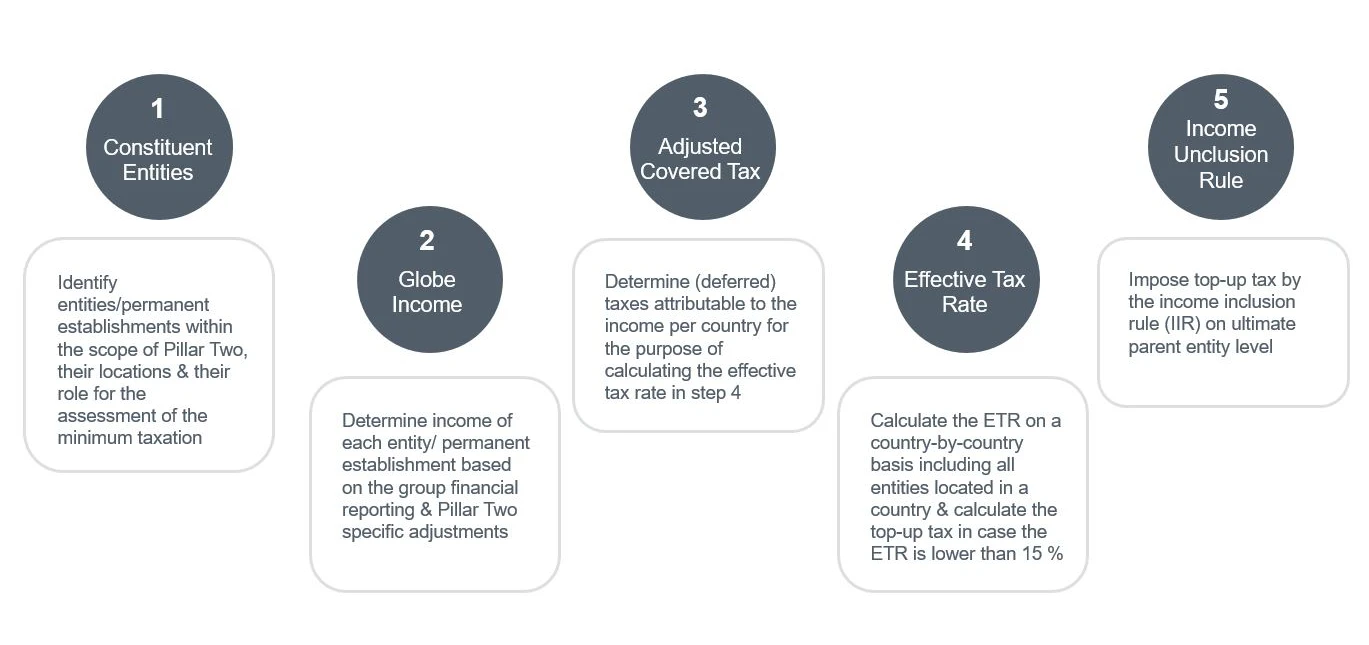

Pillar Two Global Minimum Tax Wts Global

Steps To Check Income Tax Number L Co

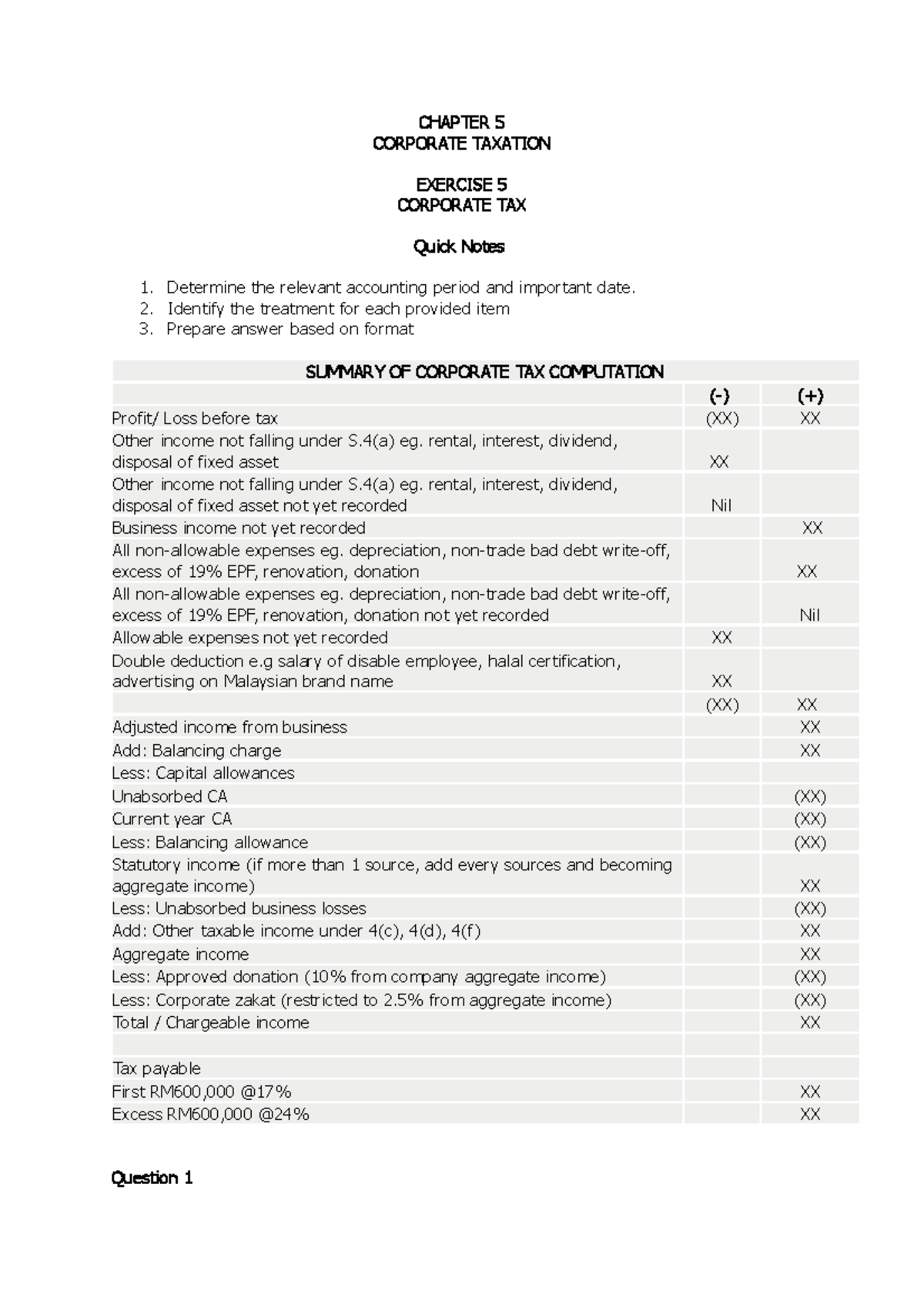

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

Minimum Corporate Taxation Questions And Answers

Gold Pound Symbol British Pound Symbol Isolated On White Paid Affiliate Sponsored Symb Como Economizar Dinheiro Simbolo De Libra Graficos Financeiros

Pillar Two Global Minimum Tax Wts Global

Minimum Corporate Taxation Questions And Answers

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

0 Response to "malaysian taxation question and answer"

Post a Comment