income tax bracket malaysia

The surtax is comprised of a 21 tax that is assessed on an individuals national income tax. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Personal Income Tax And Top Personal Marginal Income Tax Rate 2009 Or Download Scientific Diagram

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

. Easily calculate your tax rate to make smart financial decisions Get started. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. Malaysia had Asias highest Gini coefficient at 05 Brazil the highest at 057 in Latin America and the Caribbean region and Turkey the highest at 05 in OECD countries.

Foreign-sourced income is equal to or more than TWD 1 million with basic income exceeding TWD 67 million. Overall income that is earned by household members whether in cash or kind and can be referred to as gross income. Personal income tax rates.

Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. Japanese local governments prefectural and municipal governments levy local inhabitants tax on a taxpayers prior year income.

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries or the international aspects of an individual countrys tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. Tax Bracket Calculator.

There are also special tax incentives for new immigrants to encourage aliyah. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. Bracket tax on personal income.

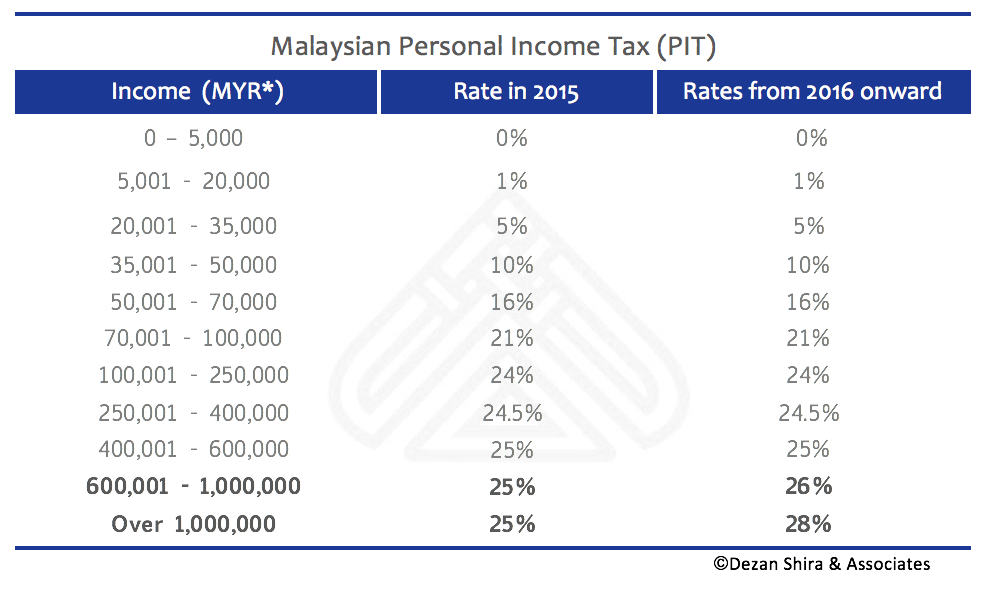

In 2019 the average monthly income in Malaysia is RM7901. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Taxable income Tax payable on this income Effective tax rate MYR 0 5000 Nil 0 MYR 5001 20000 1 for each MYR 1 over MYR 5000 0 075.

Improving Lives Through Smart Tax Policy. Following Israels social justice protests in July 2011 Prime Minister Benjamin Netanyahu created the Trajtenberg. The short-term capital gains tax rate equals your.

If the employee is considered a non-resident for Mexican tax purposes the tax rate applicable to compensation will vary from 15 to 30. Income from employment business and capital. Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C.

In the US if in the year of selling the property your family member falls within the 10 to 12 ordinary income tax bracket he or she could avoid the capital gains tax. Norway is divided into 11 counties and subdivided into 356 municipalities and the state tax. Income is taxable at graduated progressive rates ranging from 0 to 35.

W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. Income tax varies dependent on income levels in any specific tax year personal tax years run from 1 April to 31 March. Amount RM Individual chargeable income less than RM35000.

The 35 tax bracket is reached at annual chargeable income in excess of 60000. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. In tabling Budget 2023 Tengku Zafrul said that this would mean those in the aforementioned bracket would have their income tax payable rate slashed from 13 per cent to 11 per cent and 21 per cent to 19 per cent for those earning between RM70001 and RM100000.

2021 Income Tax rate Effective tax rate Max. There are prescribed forms through which the income earned by a person and the income tax. Tax rates for basis tax year 2022 are.

Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007. Income bracket in.

The task that must be completed. The general income tax base comprises all categories of taxable income ie. Generally in Japan the local inhabitants tax is imposed at a flat rate of 10.

As well as income from a self proprietorship and certain remuneration from partnerships. You should file income tax returns even if your income is below the taxable bracket. Husband and wife separately assessed and each chargeable income does not exceed RM35000.

Do i declare in Malaysia in which may required to pay tax in malaysia. In 2016 and 2019 average income recipients in Malaysia was 18 persons. Tax of bracket Cumulative tax 0 14000 105 105 1470 1470 14001 48000 175 105 - 155 5950 7420.

Type of rebate. The OECD average for total populations in OECD countries was 046 for the pre-tax income Gini index and 031 for the after-tax income Gini index. Know how much to withhold from your paycheck to get.

Is the middle income number within a range of. Situations covered assuming no added tax complexity. 10 12 22 24 32 35 or 37.

If the IBT payable is greater than the regular income. Malaysia Thailand Denmark Mexico Turkey Fiji. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets.

Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23. The first MXN 125900 of employment income received in a 12-month floating period will be tax exempt. However a real property gains tax RPGT has been introduced in 2010.

Whereas an individual in the 30 bracket will save Rs 30000 on the same investment. This ranges from a work salary to capital gains or dividends lease transactions or even selling clothes on the sidewalk as long as the earnings are over 150k per year. The Important dates to remember for individuals who fall under the bracket to pay Income Tax for FY 2022-23 AY 2023-24 is mentioned in the table below.

Know about Income tax department slabs efiling calculation payments refunds and Latest updates in Tax. 20 of herhis income as tax will save around Rs 20000 on an investment of Rs 1 lakh. Taxation in Israel include income tax capital gains tax value-added tax and land appreciation taxThe primary law on income taxes in Israel is codified in the Income Tax Ordinance.

Only certain taxpayers are eligible. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns. The list focuses on the main types of taxes.

All forms of earnings are generally taxable and fall under the personal income tax bracket. Under the IBT Act a taxpayer must calculate the amount of IBT due on income subject to IBT after adding back certain items and compare the result with the regular income tax payable.

Income Tax Malaysia 2019 Calculator Madalynngwf

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Personal Tax Rate 2016 Malaysia Gingerqwe

Malaysia Personal Income Tax Rates 2022

Pdf Marginal Income Tax Rates And Economic Growth In Developing Countries Semantic Scholar

Bursa Dummy Tax On Rental Income

Ppa Malaysia The Prs Tax Relief Was Specially Introduced Facebook

North Carolina Providing Broad Based Tax Relief Grant Thornton

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Iceland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Screen Shot 2016 02 14 At 2 35 35 Pm Asean Business News

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Effective Tax Rate Formula Calculator Excel Template

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

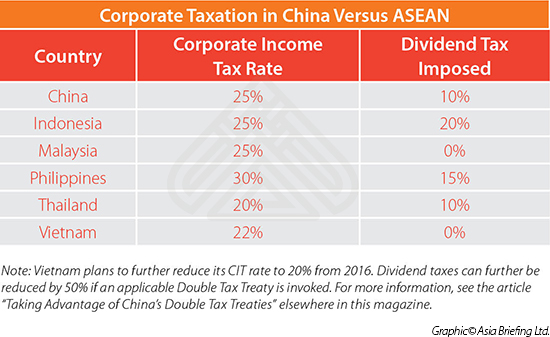

Asiapedia Corporate Taxation In China Versus Asean Dezan Shira Associates

What Is The Difference Between The Statutory And Effective Tax Rate

Malaysia Personal Income Tax Rates 2021 Ya 2020

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

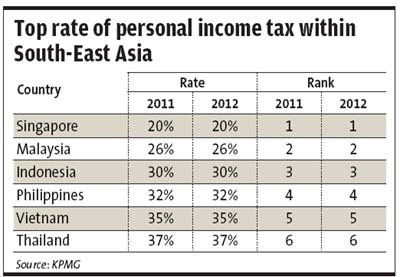

Malaysia Tax Rate Second Lowest In South East Asia The Star

0 Response to "income tax bracket malaysia"

Post a Comment